An article <a href="http://Read here.”>Asiaone Business which reported on how some big and young earners in Singapore are the big spenders and trapped borrowers.

Many people sometimes may need to borrow cash for personal reasons they have for example parents fell ill and requires some money to pay hospitalization bills (this could easily be taken care if earlier planning is taken care, read my other entry on managing your risk here), children education, and other possible reasons. Whatever reasons you may have, these are the things you should look for before taking up the personal loan:

TEN THINGS TO LOOK FOR BEFORE TAKING UP A PERSONAL LOAN

1. Is there really a need to borrow? Many times we do not really need to borrow. The worse type of loan is to support your lifestyle like car, expensive spa treatment, traveling, expensive hobbies, shopping etc. The only loan you should consider is when you want to use it to grow your business or urgent personal needs. (Read here about managing your cashflow)

2. Is there any other alternative beside taking the loan, for example if you can save up and delay the need, you could borrow from your family members and repay them over the period or use interest free installment scheme.

3. Are you always in debt? If the answer to this question is yes, try to use re-financing to clear the highest interest debt as soon as possible. You should possibly watch your expenses and eliminate all the credit cards that you are holding and only spend from what you have each month.

4. If this is the first time you are taking loan, remind yourself not to incur another loan during the repayment period. The habits always build up easily when you let your guard down.

5. Ask yourself how much can you pay per month and how much do you need to borrow? This will determine the duration of your loan. Factor this loan into your monthly expenses and aim to finish it as soon as possible if you are taking a variable payment or if not, check what is the early payment charge for fixed payment.

6. Always look for Effective Interest Rate (EIR) instead of Annual Interest Rate (AIR). EIR as the name imply will factor in any processing fee, insurance fee or sometimes discount on interest given by the institutions. This info is useful when you need to compare across different loan schemes.

7. For personal loan, it doesn’t mean that the longer the duration the higher the interest, or the bigger the amount the lower the interest, I have placed a chart here for your benefits of comparison so you get what I mean.

*The monthly repayment is for loan of $30k over a period of 1,2,3,4 or 5 years of loan repayment. It is just an estimation and the EIR is correct as of today. Please check with the banks for more accurate rate. All rights reserved.

8. It is surprising to see that our largest local bank loan interest rate is the highest compare to the other local banks and if you can see it is the foreign banks that are offering cheaper rate. I believe that because of the accessibility of the bank in your neighbourhood and also most likely you have an existing account with them, the bank can afford to charge higher. The foreign bank may need you to open an account with them or you may need to go to their branch to pay which could be inconvenient at time. Therefore beside the EIR, do check the ease of repayment.

9. Do find out what is the late payment fee. Some may offer lower interest rate but may charge you very high late payment fee. Ensure you do not miss your payment if you taking this type of loan.

10. Lastly, for those loan with overhead costs i.e. insurance fee or processing fee, you may need to borrow higher than your original amount. For e.g. If we use the $30k loan, the POSB has a total overhead fee of 4%, in order to get $30k, I need to borrow $31,250($31250*0.96 = $30k) which will result in higher EIR.

Hope this is useful for those of you who are considering taking up loan. Feel free to ask me any questions or share your experience on personal loans with the banks or any money lender institutions.

To read my other entries on personal finances, click here.

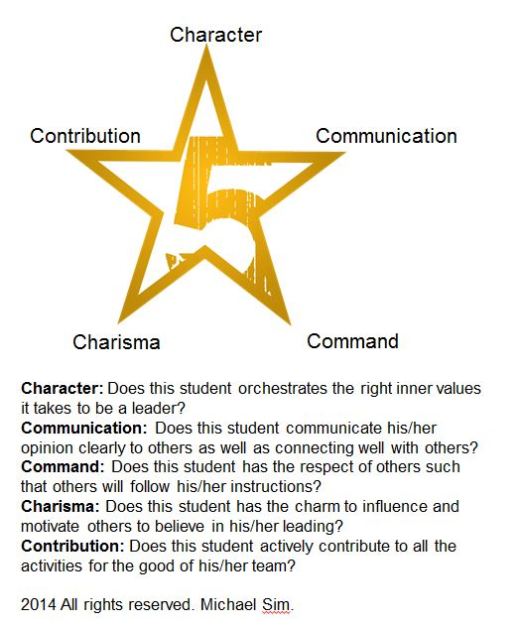

Since 2007, Michael Sim helps people to understand and better manage their finances. He holds the ChFC certification and currently works as freelance trainer and consultant. He also helps his client to understand and manage their finances using MSYF(Make Simple Your Finances). For consultation and business opportunities, please Email Michael.

© Michael Sim. You are permitted and encouraged to reproduce and distribute this material provided that you do not alter the wording in any way and do not charge a fee beyond the cost of reproduction. For web posting, please do not quote this document in it’s entirety, but in part, and link to this page. Any exceptions to the above must be approved by the author.

1. Saving is a thing in the past. You save what you need for rainy days and short term needs like house downpayment, wedding expenses or short term unemployment.

1. Saving is a thing in the past. You save what you need for rainy days and short term needs like house downpayment, wedding expenses or short term unemployment. 1. You should make your life insurance your first financial plan for yourself when you start work as there is no other plan could give you the cash you need when unexpected things happen.

1. You should make your life insurance your first financial plan for yourself when you start work as there is no other plan could give you the cash you need when unexpected things happen. 1. Pay yourself first before you pay others.

1. Pay yourself first before you pay others.